|

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

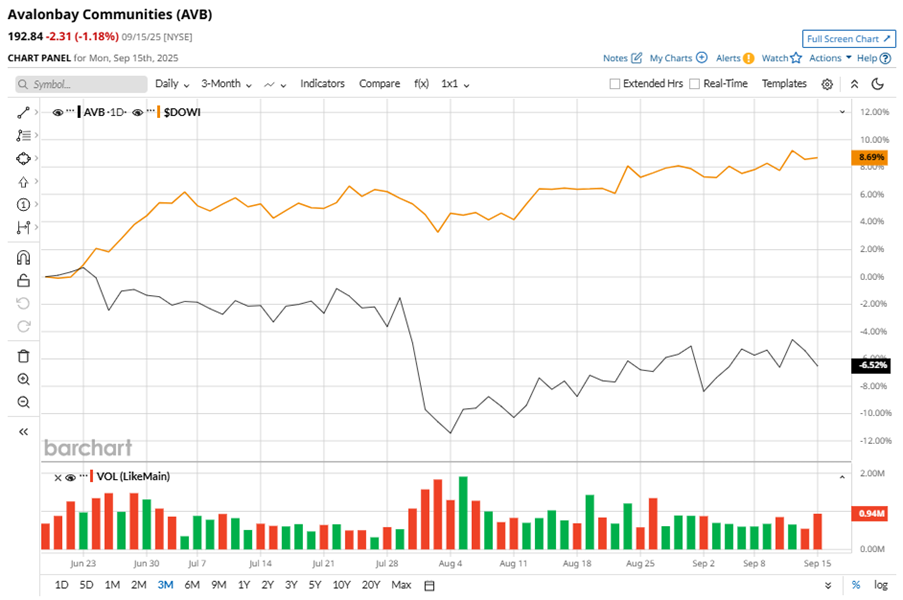

Is AvalonBay Communities Stock Underperforming the Dow?

AvalonBay Communities, Inc. (AVB), headquartered in Arlington, Virginia, is an equity REIT that develops, redevelops, acquires, and manages apartment communities in leading metropolitan areas. Valued at $27.5 billion by market cap, the company has a 30-year track record in some of the best U.S. markets across 12 states and Washington, DC. Companies worth $10 billion or more are generally described as “large-cap stocks,” and AVB perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the REIT - residential industry. AvalonBay excels through its concentrated strategy in high-barrier markets, strong brand equity, robust balance sheet, technological capabilities, efficient supply chain, and proactive sustainability initiatives, driving operational excellence and strategic growth. Despite its notable strength, AVB slipped 19.4% from its 52-week high of $239.29, achieved on Nov. 27, 2024. Over the past three months, AVB stock declined 6.5%, underperforming the Dow Jones Industrials Average’s ($DOWI) 8.7% gains during the same time frame.  In the longer term, shares of AVB dipped 12.3% on a YTD basis and fell 17.9% over the past 52 weeks, underperforming DOWI’s YTD gains of 7.9% and 10.9% returns over the last year. To confirm the bearish trend, AVB has been trading below its 50-day moving average since mid-December 2024, with some fluctuations. The stock is trading below its 200-day moving average since early March.  AvalonBay faces challenges from elevated rental unit supply in select markets, high interest expenses, and delayed development occupancies, resulting in lower occupancy rates, higher concessions, and decreased NOI in markets such as Denver and Maryland. On Jul. 30, AVB shares closed down more than 3% after reporting its Q2 results. Its FFO per share of $2.82 surpassed Wall Street expectations of $2.80. The company’s revenue was $760.2 million, missing Wall Street forecasts of $761.7 million. The company expects full-year FFO in the range of $11.19 to $11.59 per share. In the competitive arena of REIT - residential, Mid-America Apartment Communities, Inc. (MAA) has taken the lead over AVB, showing resilience with a 9% downtick on a YTD basis and 15.4% losses over the past 52 weeks. Wall Street analysts are reasonably bullish on AVB’s prospects. The stock has a consensus “Moderate Buy” rating from the 24 analysts covering it, and the mean price target of $218.39 suggests a potential upside of 13.2% from current price levels. On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|