|

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

How Is Willis Towers Watson's Stock Performance Compared to Other Insurance Brokers Stocks?/Willis%20Towers%20Watson%20Public%20Limited%20Co%20office%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

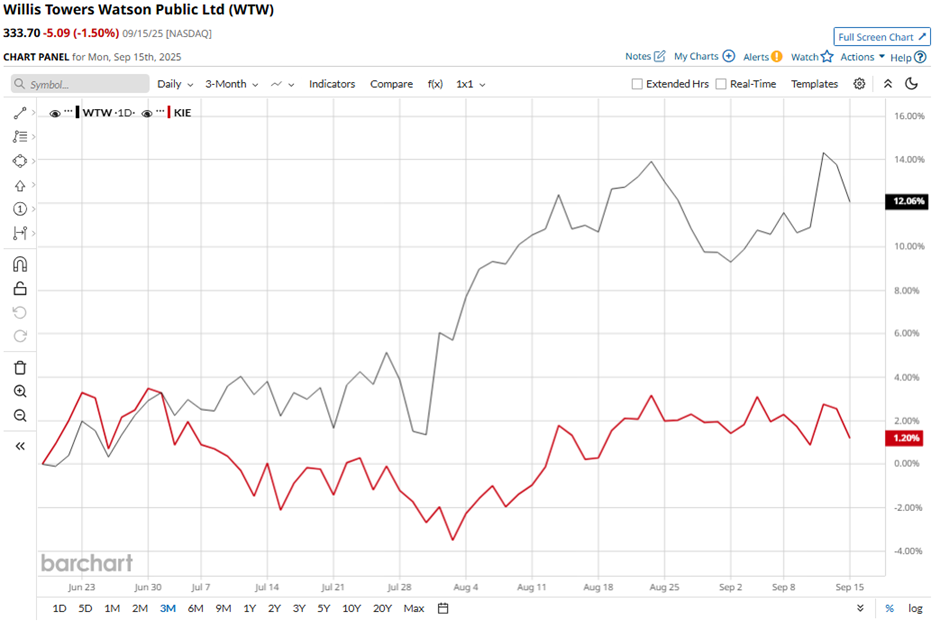

With a market cap of $32.6 billion, Willis Towers Watson Public Limited Company (WTW) is a leading global advisory, broking, and solutions company, serving clients worldwide. Through its two segments: Health, Wealth & Career and Risk & Broking, the firm delivers services that help organizations manage risk, optimize benefits, and enhance performance. Companies valued over $10 billion are generally described as “large-cap” stocks, and Willis Towers Watson fits right into that category. Headquartered in London, the United Kingdom, the company combines deep expertise, data-driven insights, and innovative solutions to support businesses of all sizes. Shares of the advisory, broking and solutions company have dipped over 3% from its 52-week high of $344.14. WTW stock has increased 12.6% over the past three months, outperforming the SPDR S&P Insurance ETF’s (KIE) marginal rise over the same time frame.  In the longer term, the stock has risen 6.5% on a YTD basis, outpacing KIE’s 3.4% gain. Moreover, shares of Willis Towers Watson have soared 14.8% over the past 52 weeks, compared to KIE’s 4.5% return over the same time frame. WTW stock has been trading above its 50-day and 200-day moving averages since August.  Shares of WTW climbed 4.6% on Jul. 31 after the company reported strong Q2 2025 results, with adjusted EPS of $2.86, beating the consensus estimate and rising 20% year-over-year. Revenue came in at $2.26 billion, topping expectations, driven by solid organic growth in the Risk & Broking segment and improved margins from cost reductions. Additionally, rival Brown & Brown, Inc. (BRO) has underperformed WTW stock. Shares of Brown & Brown have decreased 10.4% on a YTD basis and 12.2% over the past 52 weeks. Although the stock has outperformed, analysts remain cautiously optimistic about its prospects. WTW stock has a consensus rating of “Moderate Buy” from 22 analysts' coverage, and the mean price target of $365.31 is a premium of 9.5% to current levels. On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|