|

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

What Are Wall Street Analysts' Target Price for Aon Stock?/Aon%20plc_%20building%20photo-by%20J2R%20via%20iStock.jpg)

With a market cap of $78.2 billion, Aon plc (AON) is a leading multinational professional services firm headquartered in Dublin, Ireland, offering a broad range of risk, reinsurance, retirement, and health solutions worldwide. Aon delivers strategic advice and innovative services across four core segments: Commercial Risk Solutions; Reinsurance Solutions; Wealth Solutions; and Health Solutions. The Dublin, Ireland-based company's shares have outperformed the broader market over the past 52 weeks. AON has increased 23.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12.5%. However, shares of AON are up marginally on a YTD basis, slightly lagging behind SPX’s 1.3% rise. In addition, the insurance brokerage has also slightly outpaced the Financial Select Sector SPDR Fund’s (XLF) 22.3% return over the past 52 weeks.

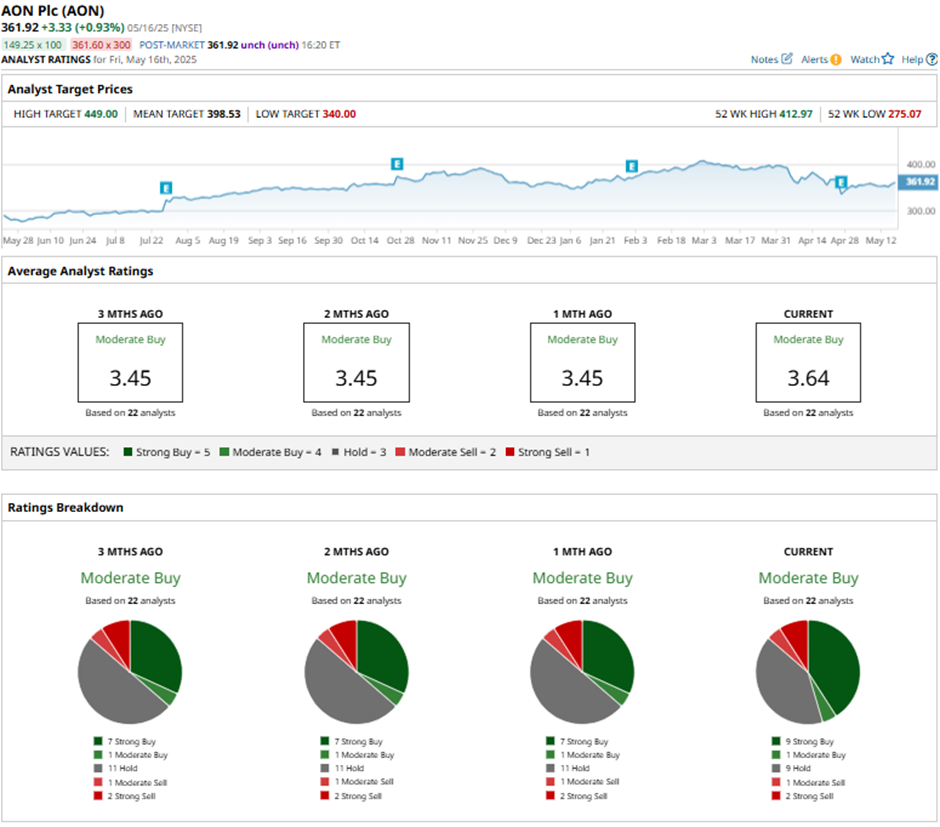

Shares of Aon tumbled 8% on Apr. 25 after the company reported disappointing Q1 2025 results, with adjusted EPS of $5.67 and revenue of $4.7 billion, missing the consensus estimates. Despite 16% year-over-year revenue growth and 5% organic growth, the results were pressured by a 25% surge in operating expenses to $3.3 billion, driven by NFP-related costs, long-term investments, and increased amortization. For the current fiscal year, ending in December 2025, analysts expect AON’s adjusted EPS to grow 7.8% year-over-year to $16.81. The company’s earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions. Among the 22 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, one “Moderate Buy,” nine “Holds,” one “Moderate Sell,” and two “Strong Sells.”

This configuration is more bullish than three months ago, with seven “Strong Buy” ratings on the stock. On May 13, Goldman Sachs upgraded Aon to “Buy" with a $408 price target, citing strong potential for above-expectation organic growth and free cash flow by 2026. As of writing, AON is trading below the mean price target of $398.53. The Street-high price target of $449 implies a potential upside of 24.1% from the current price levels. On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|